This internationally recognised qualification will further enhance your skills and prepare you for the next step in your accounting career.

This course covers a range of complex accounting tasks such as preparation of reports and returns and maintaining cost accounting records. You will gain core skills including analysing variances, reconciling ledgers, making provisions for doubtful and irrecoverable debts, the use of spreadsheets to manage information and professional ethics. You will gain practical, real-world accounting and finance skills, with the freedom to study flexibly, from anywhere. This is also coupled with award-winning online resources and outstanding learner support.

Who is suitable?

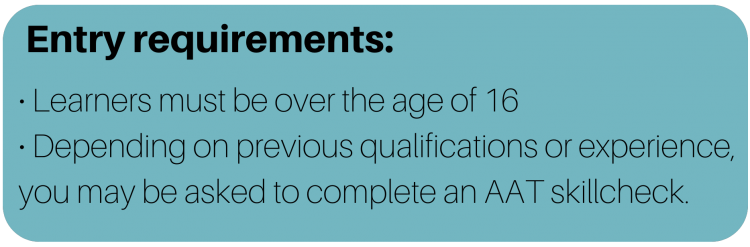

This course is suited to learners who have ideally completed the Level 2 Foundation Certificate in Accounting or learners who are already working within finance at an intermediate level. If you are starting on your career path with AAT, we suggest you begin with the Level 2 Certificate before progressing onto the Level 3 Diploma. The AAT Skillcheck can help guide you on which qualification you should start with. We can guide you through all three layers of AAT, taking you through all three qualifications.

What will you learn?

The course is split into six manageable units, with an additional synoptic revision unit:

• Advanced Bookkeeping

• Final Accounts Preparation

• Management Accounting: Costing

• Indirect Tax

• Ethics for Accountants

• Spreadsheets for Accounting

• Additional Synoptic Assessment Preparation.

Benefits

• Gain a nationally recognised qualification

• Improve your skills to help create a long-standing career pathway in bookkeeping and accounting

• Courses are delivered as distance learning, allowing learners to choose when and where to study

• Personal tutors are assigned to ensure learners have the support needed to succeed.

Due to the AAT syllabus change in September 2022 please read these changes. Click here