This course covers a range of basic principles such as costing, double entry bookkeeping, and using accounting software.

You will gain core skills including processing of payments and receipts, preparing invoices, completing bank reconciliations, and business communication skills including letters, memos, and informal reports.

You will gain practical, real-world accounting and finance skills, with the freedom to study flexibly, from anywhere.

Who is suitable?

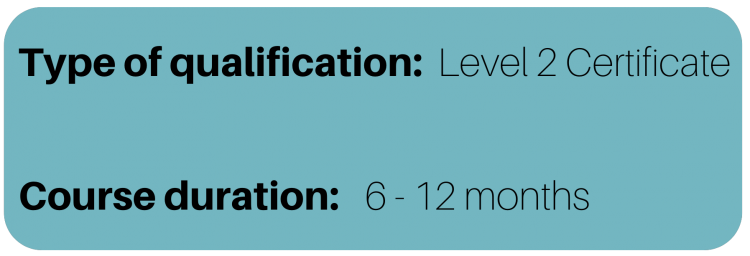

Unlike some qualifications, there are no entry requirements for the Level 2 Certificate and you don’t necessarily need any relevant work experience. This qualification is ideally suited to learners starting their career in finance or those within an administration role within a finance department.

This qualification is also suited to someone new to accounting and finance. If you are starting on your career path with AAT, we suggest you begin with the Level 2 Certificate before progressing onto the Level 3 Diploma. The AAT Skillcheck can help guide you on which qualification you should start with. This can guide you through all three layers of AAT, taking you through all three qualifications.

What will you learn?

This course is split into five manageable units, with additional synoptic revision units:

• Bookkeeping Transactions

• Bookkeeping Controls

• Elements of Costing

• Work Effectively in Finance

• Using Accounting Software

• Additional Synoptic Assessments Preparation.

Benefits

• Gain a nationally recognised qualification

• Improve your skills to help create a long-standing career pathway in bookkeeping and accounting

• Courses are delivered as distance learning, allowing learners to choose when and where to study

• Personal tutors are assigned to ensure learners have the support needed to succeed.

Entry Requirements

Learners must be over the age of 16.

Due to the AAT syllabus change in September 2022 please read these changes. Click here